- Blog

- OCR is No Longer the Answer (But Here’s What Is)

OCR is No Longer the Answer (But Here’s What Is)

According to the Management Events report “Beyond Finance: Rise of the Digital CFO,” “65% of financial leaders are prioritising OCR as a top technology investment.” And it’s likely they’re doing so due to heightened pressure to become more data driven. More technology equals more data. Right? Wrong—not when it comes to OCR technology. Read on to learn why OCR isn’t the answer to fueling your organisation with data or for future-proofing your business.

What is OCR?

Optical Character Recognition (or OCR) is a widely used technology programmed to recognise text inside of images. OCR recognition technology has the ability to convert these images and the text included in them into machine-readable text data. Through the use of a scanner, OCR technology can “read” paper invoices and extract necessary information that can then be used to populate invoice fields in a database. Sounds good, right?

Unfortunately, though OCR technology seems to take out the majority of manual invoice processing hassles, that’s not exactly the case. You might be reducing the human interference with paper, but you’re not necessarily reducing the overall workload: Font, paper quality, creases and receipt stamps influence the readability of the image pixels to be interpreted and make human validation of the data indispensable. And if you want to use OCR to not only capture data on the invoice header level but also drill down to line level items, it can get quite expensive.

So, the 65% of financial leaders who are prioritising OCR in their technology initiatives might want to think again. Though the pressure to integrate data into the business strategy is higher now than ever, OCR isn’t the answer given its lack of data quality, accessibility, and reliability.

If OCR isn’t the future, what is?

Business leaders should consider ways they can increase automation and digitisation efforts while also contributing to the quality, quantity, and availability of their data. How? Simple – electronic invoicing. According to Gartner, there are a few ways to gather worthwhile data, automate and digitise your process, and continuously improve processes.

1. Increase supplier participation by offering multiple invoice ingestion options.

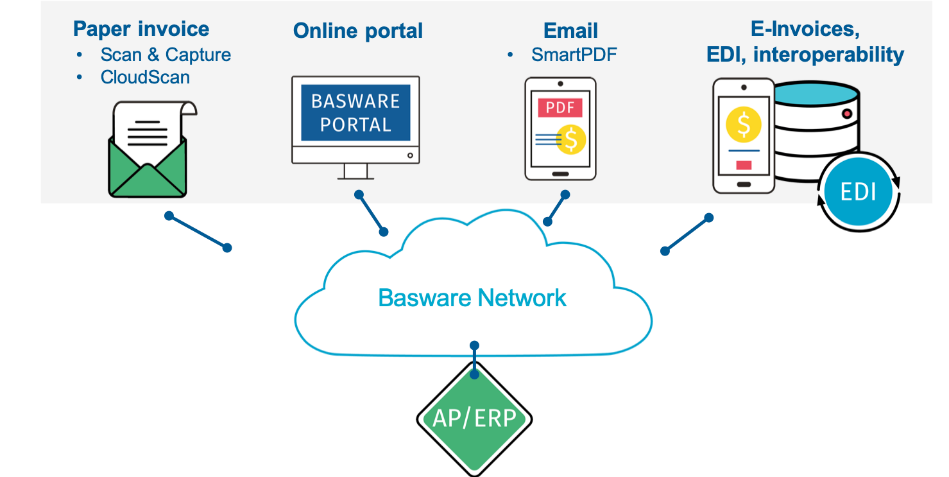

The best way to get suppliers on board with electronic invoicing (e-invoicing) is by making their transition as seamless as possible. That’s where the Basware Network comes in. It’s free and easy for suppliers to join and offers a variety of integrated solutions so your suppliers can continue sending invoices the same way they do today. ALL invoice types (paper, electronic, EDI, PDF, etc.) can be received, converted and sent to you as true e-invoices in 100% electronic format (i.e.- invoices with structured data formatting for machine reading without human intervention) through the Network. You can truly get all of your suppliers using the Network to send you invoices and receive other financial documents like purchase orders (POs) helping you achieve your targets like high e-invoicing rates and 100% spend visibility.

2. Use Accounts Payable Invoice Automation (APIA) solutions with advanced, AI-based matching capabilities

Whereas OCR can’t provide a true hands-off approach to invoice processing, AI-based matching provides all the key elements needed to reach that elite level of automation. Traditional matching leaves your AP team with a variety of issues, often leading to manual exception handling. But APIA technology uses intelligent algorithms, machine learning, and AI to decrease the need for exceptions, free up users’ time, and keep it out of additional workflows.

3. Continuously enhance value through predictive and advanced analytics

The 65% of financial leaders in the Management Events report were right to seek a way to address the growing need for data-based business strategy. They were just looking in the wrong place. It’s true that future success in business relies heavily on the data you have, how you collect it, and how you use it. Advanced and predictive analytics should empower AP teams to prevent late payments, increase e-invoice rates, capture more early payment discounts, resolve process bottlenecks, and improve supplier relationships. (Learn more about Basware Analytics.)

Couldn’t I just use my ERP for e-invoicing?

ERP isn’t AP. But, surprisingly around half of all companies are still using their ERP suite to process invoices. But ERP suites aren’t equipped to what a true e-invoicing Network and its accompanying technologies can do. (Learn about other capabilities in the blog.)

Additionally, ERPs fail to provide the data-driven algorithms that help fix a variety of invoice matching issues. Basware Purchase to Pay, on the other hand, can easily address and correct invoice processing roadblocks such as:

-

When an invoice has no line-level details

-

When the PO currency doesn’t match the invoice currency

-

When the PO has one tax rate and the invoice has another

-

When there is no PO and the invoice isn’t linked to an agreement OR contract.

(Read more about how Basware addresses these challenges in the blog.)

e-Invoicing, SmartPDF, Smart Coding = Your New Answers

If OCR is out, then e-invoicing, SmartPDF, and Smart Coding are in. We mentioned above how e-invoicing improves supplier relationships, increases automated matching rates, and provides the data needed for advanced and predictive analytics. But additional features such as Basware SmartPDF and Smart Coding add supplementary value and retrieve additional data for your organisation.

SmartPDF eliminates the manual work and risk of errors since nothing needs to be printed, scanned, or re-entered. Instead, all the necessary invoice data is extracted from the readable PDF and automatically transfers into your AP or ERP system, reducing invoice cycle times and cutting down AP workloads. It’s simple:

1. Invite your suppliers use the SmartPDF service.

2. Your supplier sends PDF invoices via email to a dedicated email address.

3. Basware SmartPDF uses AI to determine if the PDF is a readable PDF or an image PDF.

4. Readable PDFs are sent through the Basware Network, converting the attachment into an e-invoice in near real time, without OCR, data errors, or delays.

5. The extracted invoice data is delivered electronically into your AP or ERP system

Smart coding uses machine learning to automate the handling of non-PO invoices and get one step closer to touchless processing. It eliminates the need for AP users to manually code invoices when there isn’t a PO created to match the invoice. Using an advanced machine learning algorithm, smart coding searches and analyses historical invoice data to recommend the proper general ledger (GL) coding for non-PO invoices. The more you use the feature and the more data you have running through your system, the more accurate its recommendations become.

Ready to learn more?

Your organisation should and can take the next step in intelligent automation and drop OCR technologies for more advanced, data-driven ones such as SmartPDF. Learn more and download our factsheet, “Make the ‘O’ in OCR Obsolete with Basware SmartPDF.”

Want to chat more about how we simplify AP processes? Contact us!

Subscribe to the Basware Blog!

Related

-

By Leigh CelonesTop AP Automation Trends 2026: What Do Finance Teams Need to Prepare for Now?

-

By Olav MaasFrom Bottlenecks to Breakthroughs: Rethink PO Invoice Processing with AI

-

By Christopher BlakeHow To Fix Broken and Disconnected Invoice Processes with Invoice Lifecycle Management

-

By Jon StevensAP First, ERP Next: KION’s Smarter Path to SAP S/4HANA

-

By Jon StevensConnect the Dots Between AP and Your S/4HANA Migration

-

By Leigh CelonesFrom Chaos to Clarity: Rethink Non-PO Invoice Handling with AI

-

By Basware RepresentativeBest Defense Against AP Crime: 6 Proven Measures Webinar

-

By Martti NurminenRethinking Accounts Payable: AI, Compliance & Automation