- Blog

- Maximise the Value of AP Automation: New Analytics Dashboards for Payment Plans

Maximise the Value of AP Automation: New Analytics Dashboards for Payment Plans

Payment plans just got even better with new analytics. Read on to learn how you can get even more value from AP automation.

Getting visibility into non-PO invoices poses a challenge for many organisations and a large chunk of those invoices (about 30%) are recurring invoices – the rent, utilities, subscription fees, cleaning services, etc. If you read our earlier post on the topic, you know that we recommend payment plans to automate recurring non-PO invoices and get critical visibility into that area of spending. Now you can optimise those payment plans and AP automation by using the data you’re collecting and new analytics dashboards available in Basware.

What are payment plans and why are they important?

Payment plans are a tool that enable AP teams to schedule automatic payments for recurring invoices.

Payment plans can be configured in three ways:

1. Scheduled payments to automate recurring invoices that require payment at regular intervals

2. Budget-based to automate recurring invoices to a specific budget

3. Self-billing to automate recurring invoices for amounts that fall within certain ranges

Payment plans allow organisations to take AP automation a step further by extending digital processing to more invoice types. In the journey to touchless invoice processing, organisations apply best-fit matching capabilities, then layer on payment plans and leverage machine learning functionality like smart coding to process as many invoices as possible without human intervention.

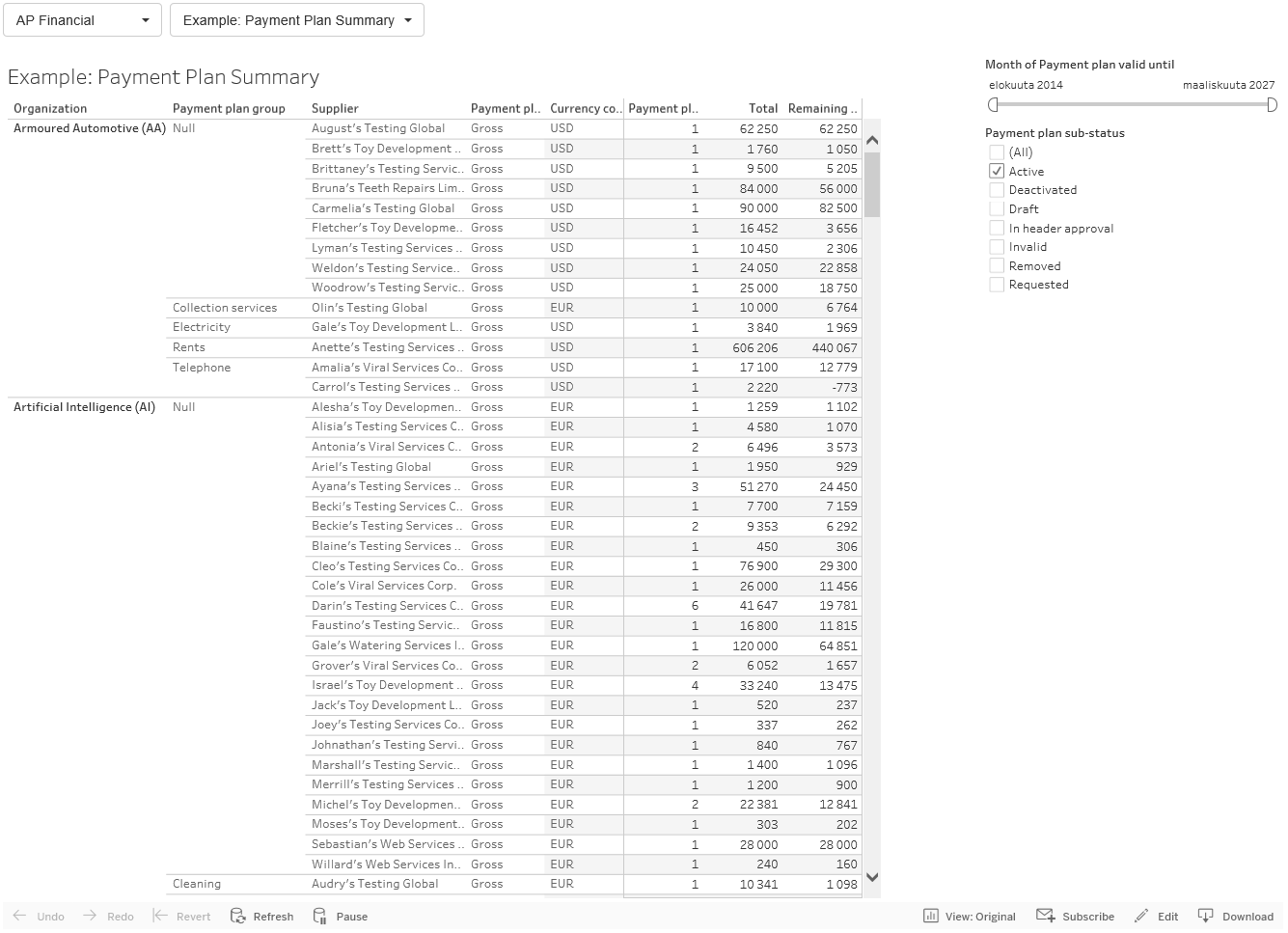

See Payment Plans at a Glance

The first new payment plan analytics dashboard shows a summary of all your payment plans with common dimensions. This enables you to quickly see the active payment plans you have with various suppliers and answer questions like:

-

How much spend have is committed via payment plans (by organisation, supplier, category, etc.)?

-

How much spend is currently being matched to payment plans?

-

How much is remaining on each payment plan?

Maximise Payment Plan Use

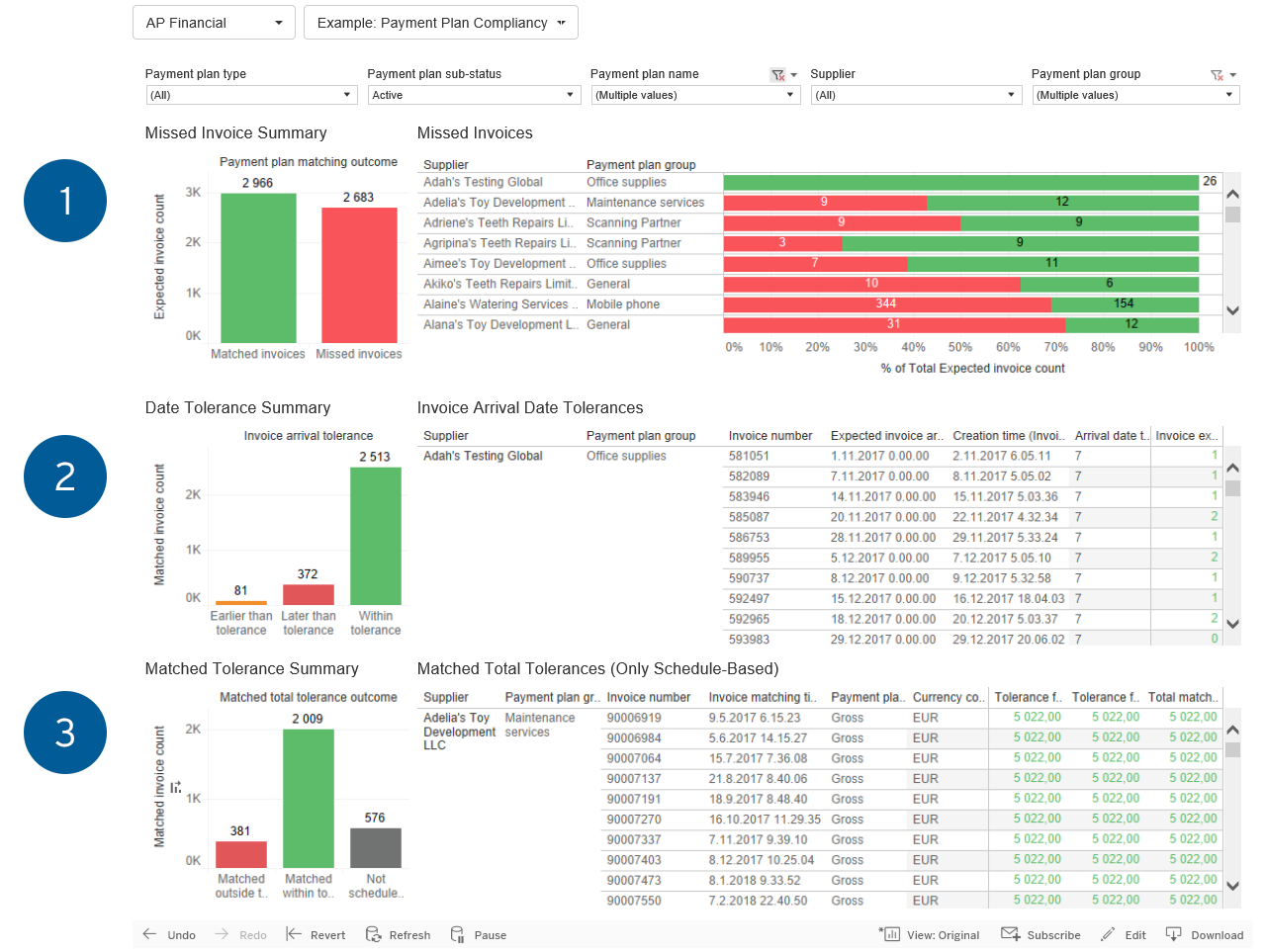

The second new payment plan dashboard – Payment Plan Compliancy – gives you visibility into why invoices that are associated to a payment plan are not matching. This dashboard offers three views to support you in ensuring payment plans are not failing and are properly configured to prevent over or under payment, allowing you to maximise the benefit of this automation:

-

Missed Invoice Summary: Find the Root Cause of Failing Invoices

The Missed Invoice Summary shows how many payment plan invoices were received and matched versus how many invoices were not associated with the payment plans. This alerts you to areas where you can drill down and find the answers to questions that help determine the root-cause of problems – Are there supplier challenges that need to be addressed regarding sending invoices? Is there missing data on the invoice? Why are these invoices being sent without being associated to the payment plans in place? -

Date Tolerance Summary: Optimise Invoice Timing

The new Date Tolerance Summary gives you visibility into invoice arrival times for payment plan invoices, so you can ensure that suppliers are sending you invoices at the right time each month. With expected arrival and creation dates, you can see where you need to work with suppliers to adjust when they send invoices to ensure on-time payments. -

Matching Tolerance Summary: Prevent Overpayment

For schedule-based payment plans, the Matching Tolerance Summary shows you matching outcomes for these invoices. Schedule-based payment plans are most often used for recurring invoices that occur each month for the same amount – like internet service or mobile phone bills. By looking at why certain invoices on this type of payment plans are not automatically matching, you can determine if you are being billed too much or less than you anticipated. In a manual environment these invoices would often be processed and paid without proper questioning as to why the amounts were different than expected. Instead, you can dig in and find out why you are being billed certain amounts and prevent overpayments.

Figure 1: Payment Plan Compliancy Dashboard

Customise Payment Plan Data

The new payment plan analytics dashboard also enables customisable reports so you can see the data in the way you need it.

Ready to learn more?

Check out the factsheet on Basware’s payment plan enhancements and contact us – we’re here to help.

Subscribe to the Basware Blog!

Related

-

By Jason KurtzFour Forces Shaping the Future of AP with Invoice Lifecycle Management

-

By Christopher BlakeWhat is Invoice Lifecycle Management and How Does it Improve Cost, Control and Compliance?

-

By Olav MaasFrom Bottlenecks to Breakthroughs: Rethink PO Invoice Processing with AI

-

By Christopher BlakeHow To Fix Broken and Disconnected Invoice Processes with Invoice Lifecycle Management

-

By Jon StevensAP First, ERP Next: KION’s Smarter Path to SAP S/4HANA

-

By Adam LustigThe Integration Pyramid: Build It Right, Scale It Fast

-

By Jon StevensConnect the Dots Between AP and Your S/4HANA Migration

-

By Leigh CelonesProven Results With Basware’s InvoiceAI: Start Asking The Questions That Matter