- e-Invoicing Compliance News Blog

- Be prepared for France’s 2024 e-invoice mandate

Be prepared for France’s 2024 e-invoice mandate

E-invoicing is becoming the global norm and France is getting on the fast track. Since 1st January 2020, e-invoicing has been mandatory for all transactions with the public sector (B2G) via the Chorus Pro portal. The next step comes on 1st July 2024 when all companies subject to VAT will be obligated to accept e-invoices. Then, depending on the size of the company, they will also start issuing invoices digitally between 1st January 2024 and 1st January 2026. Despite the staggered timeline announced by the government, companies need to start preparing for this reform today.

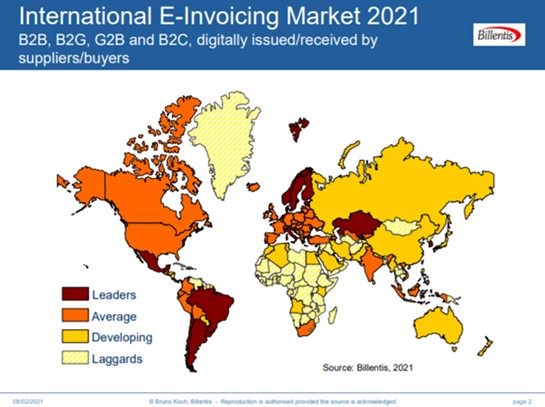

Across the globe, countries are turning more and more towards e-invoicing. Why? Because the benefits speak for themselves. E-invoicing drastically reduces the cost of processing an invoice, decreases the likelihood of invoice disputes, eliminates manual entry errors, increases global tax compliance overall, and reduces the reliance on paper processing and therefore, creates a greener more sustainable workplace.

E-invoicing is here to stay. While in the past, developments on the topic have largely been pushed by the private sector, there is an ongoing and notable shift towards governments driving the adoption of e-invoicing during the past years.

This can particularly be observed within the European Union. After the EU-wide harmonisation of e-invoicing standards through EN16931, an increasing amount of EU member-states rely on the Peppol network’s specifications for the exchange of electronic business documents. Many countries, such as France, have entered the fast track to e-invoice adoption through compulsory e-invoicing mandates.

France’s shift to mandatory B2B e-invoicing in 2024

Initiated in 2010, the French government has continuously developed a legal framework that pushes the adoption of e-invoicing. The overall goal of this pursuit is to battle VAT evasion and to set the stage for more streamlined transaction processes in the future. Similar to other countries (such as the Nordic countries), the first transaction-types affected by new regulations were B2G (business to government) transactions.

In practice, this meant that from 2020 onwards, any B2G sales invoice addressed to the public sector in France had to be an e-invoice, and it had to gain clearance through a public platform named Chorus Pro. As one of the global leaders in e-invoicing solutions, Basware has been delivering e-invoices through Chorus Pro since 2017.

After positive experiences with this system, the French government has been drafting a balanced framework for B2B (business-to-business) as well as B2C (business-to-customer) transactions in the future. At this stage, the exact specifications on what the technical implementation will look like are yet to be published. But the official ordinance no. 2021-1190 of 15 September 2021, related to generalising e-invoicing for transactions between entities subject to VAT and to the transmission of transaction data, set down the main lines of this reform:

-

The ordinance provides for a two-pronged solution making e-invoicing and e-reporting mandatory.

-

The reception of e-invoices will be mandatory for all companies subject to VAT starting 1st July 2024. Rollout of mandatory issuance of e-invoices depends on company size: 1st July 2024 for enterprise companies, 1st January 2025 for mid-sized companies and 1st January 2026 for medium to small companies and micro-companies.

-

Mandatory e-reporting will be rolled out using the same extended timeline.

-

Mandatory e-reporting also covers transactions not concerned by e-invoicing: transactions with a person exempt from VAT (B2C), cross-border transactions between exempt entities and service provider payment data.

The French government has chosen the “Y” model: companies can choose between a state-certified private dematerialisation platform or the public portal, Chorus Pro, which already handles e-invoicing for the public sector (B2G). This choice will depend on the digital maturity of each company: those already equipped with an e-invoicing system can capitalise on their investment. The others will have to invest in a private solution or choose to work with Chorus Pro.

Our decades worth of regulatory and best practice knowledge from local markets helps us to understand in detail what these new regulations mean for companies and organisations in practice. Basware stands at the forefront of the developments in France and will ensure to safeguard compliant B2B and B2G connectivity in France in the future.

Basware helps overcome compliance challenges

Basware’s e-invoicing solution helps assist you with all your compliance challenges from identifying obligations and assessing requirements to designing and managing solutions and keeping track of all the changes in the regulatory environment.

For years, Basware has been gathering regulatory and best practice knowledge from local markets, building new format conversions, connecting locally authorised compliance partners and tax authorities, and enabling the use of digital signatures and certificates. With this all under our belt, we can support you globally, covering both B2B and B2G connectivity.

As a global market leader in e-invoicing, Basware is a strong partner to consider for your global e-invoicing compliance requirements. No matter your needs, Basware helps you cover all e-invoice delivery channels.

We provide a single source for global compliance by providing support in over 60 countries through our 200+ interoperability partners. We deliver multi-channel coverage combined with localised knowledge and connectivity to third parties.

So, how is it that we can provide all this for organisations worldwide? For starters, we’ve partnered up with the leading e-invoicing and tax compliance advisers and service providers, as well as with various local partners, to ensure our business network supports our customers for compliant e-invoicing where it’s needed the most. On top of that, Basware’s in-house compliance management works together with our service management team and with external advisers and authorities to maintain and improve the compliance support provided by the Basware Network.

Our network and its country coverage is growing constantly, providing organisations like yours with compliance support. This frees organisations from the burden and complexity of global compliance and lets you focus on what matters.

As we discussed earlier, complying with global invoicing and tax mandates is complex and the consequences of non-compliance can be severe. But with Basware, you can automate your e-invoicing to assist with compliance across all B2G and B2B mandates that include different formats, processes, and archiving standards. Basware supports you in your VAT compliance work in more than 60 countries and a certified PEPPOL access point.

Efficiency, compliance, and control – thanks to automation

At the end of the day, e-invoicing compliance isn’t easy. But when you let the experts support you, you gain efficiency, compliance, and control.

Efficiency

-

Reduce the costs associated with handling global tax compliance.

-

Transparency into document statuses.

-

Free resources from a large part of the burden and complexity of e-invoicing compliance to focus on core business.

Compliance

-

Minimise errors by providing up-to-date tax information.

-

Reduce the risk of financial penalties and other sanctions associated with non-compliance with regulations.

For Basware's entire statement on how they assist with global compliance, view our General Compliance Notice on Basware Services here.