- Blog

- Basware Network Ensures Compliance with India’s new National e-invoice Mandate 2020

Basware Network Ensures Compliance with India’s new National e-invoice Mandate 2020

After establishing the new national Goods and Service Tax (GST) in 2017, the Indian government is now taking the next step to ensure the nation’s tax compliance. With the introduction of the Indian national electronic invoice (e-invoice) mandate in October 2020, a growing number of businesses will need to adopt an e-invoicing solution. This blog explains in detail what the mandate entails, who will be affected by it, and how Basware helps your organisation to stay compliant in the Indian market.

The new India national electronic invoice mandate in short

By setting up a new national e-invoicing mandate within the past few years, the Indian government has set the foundation for the electronic exchange of invoices in the future. In short, the upcoming mandate requires companies to register their organisation using a national registration platform. From then on, each GST invoice that falls under the mandate requires a special clearance, which means that invoices need to be registered in the government’s Invoice Registration Portal (IRP).

Initially and valid from October 2020 onwards, the India e-invoice mandate will affect business-to-business (B2B) invoices of larger businesses with an annual revenue of more than approximately 60 million Euros (500 cr INR) excluding Special Economic Zone (SEZ) Units, Insurance, Banking, Goods Transport Agencies, and Passenger Transport Services. Step by step, the mandate will progressively extend to B2B, B2C, and B2G invoices of smaller organisations.

“This nationwide standard to exchange billing information electronically helps organisations counter tax evasion and reduce errors, costs per invoice as well as their carbon footprint. Since this mandate requires modern technologies, it sets a strong foundation for a large-scale e-invoice uptake in India” says Manjeet Yadav, Product Manager at Basware.

The mandate and all e-invoicing initiatives worldwide will help India and other countries take the necessary steps to move away from paper invoices and upgrade operations digitally. Transitioning to digital processing is one of the strongest ways to keep businesses running smoothly regardless if teams can get into the office or not. With the right capabilities, invoices can continue their journeys electronically meaning goods keep moving, suppliers and vendors keep getting paid, and the supply chain stays active and afloat. E-invoicing assures business continuity regardless of circumstance.

What does the India e-invoice mandate mean for suppliers?

In practice, for suppliers, the mandate means that they must prepare to register their organisation within the national registration platform. In addition, they will need to implement the technical capabilities necessary to deliver invoices into the Invoice Registration Portal and to include all necessary information provided by the portal on their GST invoices. They can do this using a service provider such as Basware.

Any GST invoice that is subject to the mandate that does not carry the information provided by the Invoice Registration Portal would attract penalties under GST non-compliance rules.

Since the mandate first comes into force for larger organisations, they will be the first ones who must ensure compliance with the mandate described above. Basware’s e-invoicing solution helps Accounts Receivable teams gain process efficiencies while ensuring global compliance.

What does the India e-invoice mandate mean for buyers?

For the time being, buying organisations are not directly affected by the mandate since it only requires sending organisations to register their e-invoices inside the government platform. However, since the invoices are already created in an e-invoice format, buyers ideally already have a technical setup that allows them to receive and ingest these e-invoices directly.

Together with the mandate, the Indian government is also releasing a new mobile app for buyers. It allows them to scan an invoice's QR code to make sure that the invoice receives clearance through the Invoice Registration Portal (IRP). This helps buying organisations stay compliant, without the need for any difficult technical implementation. In addition, receiving IRP registered invoices improves any buyer’s credit score.

The benefits of receiving e-invoices for buying organisations are vast – eliminating paper from your Accounts Payable processes helps you achieve many operational benefits.

How does Basware’s e-invoicing solution work in practice?

Basware’s e-invoicing solution ensures that organisations can send their invoices electronically through the Indian national clearance system from the first day of the mandate. After organisations register themselves in the Indian registration platform, Basware will enable the supplier to send e-invoices in India through the Basware Network.

The Basware Network is interoperable, enabling companies to send and receive e-invoices with their trading partners globally — all through a single connection. It eliminates the high cost and limitations of traditional closed networks and enables companies to gain the efficiencies, visibility, and other benefits that e-invoicing delivers. This largest open network of its kind currently has more than 220 e-invoice operators on the network, connecting over one million companies globally.

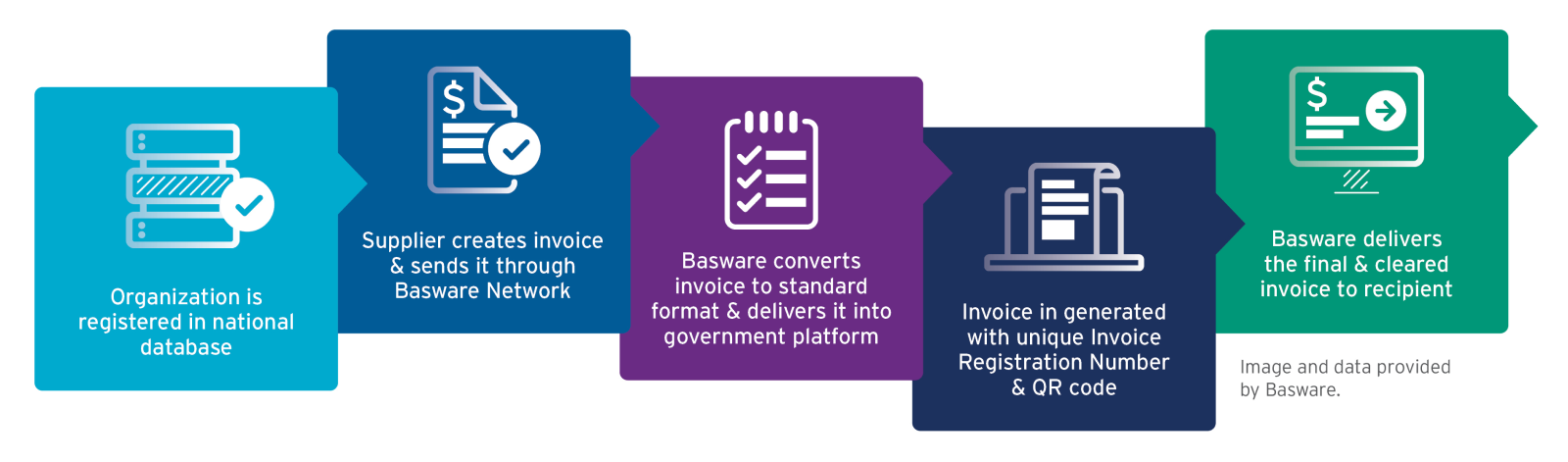

Sending e-invoices with Basware – process for suppliers

-

The organisation registers in the national database

-

The supplier creates a GST invoice and then sends it through the Basware Network

-

Basware converts the invoice to the standard format and delivers it into the Invoice Registration Portal (IRP)

-

The invoice receives clearance and is assigned a unique Invoice Registration Number (IRN) and QR code

-

Basware then delivers the final, cleared invoice to the recipient in their preferred format.

Receiving e-invoices with Basware – process for buyers

-

After a GST invoice with clearance from the IRP has been delivered via the Basware Network, Basware ensures that the invoice arrives in the buyers’ preferred format

-

Buyers now have the best possible starting point for their Accounts Payable process

Key benefits

Accounts Receivables (AR) departments that implement e-invoicing realise compliance, simplified tax returns, and reconciliation, simplified clearance for the transportation of goods, faster payment times, great efficiencies, and reduced administrative costs. Initially, implementing an e-invoicing solution may seem like a challenging process. However, the operational benefits your organisation achieves far outweigh the initial set-up cost:

-

Assured compliance

-

Improved operational benefits

-

Improved ability to forecast

-

Cuts administrative costs

-

Easier GST tax returns

-

Increases visibility and control of cash flow, working capital management

-

Helps you eliminate late payment fees and take advantage of early payment discounts

-

Improved environmental footprint

Gain e-invoice compliance in India from day one

For organisations already active in the Indian market, it is central to ensure compliance with the new mandate. E-invoicing optimises processes for both sending and receiving organisations. For questions on how Basware can help Indian organisations make this transition smoothly or for more information on how e-invoicing can help your business improve operations, contact Basware Product Manager for India e-invoicing, Manjeet Yadav. To learn how to make a successful transition from manual to paperless e-invoicing, download our e-book, “6 Steps to E-Invoicing Success.”

Subscribe to the Basware Blog!

Related

-

By Kevin KamauHow AI Is Rewiring Accounts Payable: From Automation to Autonomy

-

By Leigh CelonesTop AP Automation Trends 2026: What Do Finance Teams Need to Prepare for Now?

-

By Jason KurtzFour Forces Shaping the Future of AP with Invoice Lifecycle Management

-

By Christopher BlakeWhat is Invoice Lifecycle Management and How Does it Improve Cost, Control and Compliance?

-

By Olav MaasFrom Bottlenecks to Breakthroughs: Rethink PO Invoice Processing with AI

-

By Christopher BlakeHow To Fix Broken and Disconnected Invoice Processes with Invoice Lifecycle Management

-

By Jon StevensAP First, ERP Next: KION’s Smarter Path to SAP S/4HANA

-

By Adam LustigThe Integration Pyramid: Build It Right, Scale It Fast