- Blog

- 2020 (Re)Vision – Business takeaways from the past year

2020 (Re)Vision – Business takeaways from the past year

A year like no other, 2020 has left the world with, to say the least, plenty to think about. But what have been its most vital lessons and takeaways? What has it taught businesses about where they should be focusing their attention and resources? None of its learnings have been more important than the need for timely, comprehensive risk mitigation, writes Sami Peltonen, VP of Purchase to Pay Product Management at Basware.

So wow, 2020 huh?

Key elections (the least said there the better I guess). Significant recalibrations to crucial geo-political boundaries. Evolving international trade policies. A growing culture of protectionism. The likelihood of new tariffs and financial regulations. And oh yes, the small matter of a global pandemic of unprecedented socio-economic impact and importance.

It’s been a year unlike any other. And what’s more, its effects look certain to be felt through 2021 and perhaps far beyond. For one thing, with what started out as temporary measures to deal with Covid-19 turning swiftly into major long-term transformations, global commerce has undergone a seismic shift - possibly an irreversible one.

Who’d have thought that – on the cusp of the third decade of the third millennium – we could all have been so blind-sided? Let alone imagined the consequences?

So what has 2020 shown us? What have been its most vital lessons and takeaways? And how do we put them into practice?

How did other businesses fare in 2020?

Judging by the report we sponsored earlier this year from the Economist Intelligence Unit, A New Era: Global Trade in 2020 and Beyond, key lessons are already being learned in some quarters.

Film producers releasing straight onto digital streaming services, retail giants such as UK supermarket chain Morrisons paying their smaller suppliers faster to help keep them (and by extension their own supply chains) stay afloat amid the uncertainty. Canadian athletic apparel brand Lululemon increasing their brand value – by 40% in Lululemon’s case – a consequence of major and timely investments in their online presence, digital infrastructure and strategic partnerships.

Elsewhere, the pandemic is “hastening a strategic shift” companies were already in the throes of making. The digitisation of processes, cloud storage, the eradication of paper and manual transactions, and so on.

What do all these improvements have in common? What is the discipline to which they all closely correlate? Prudent financial practice; the need to optimise and manage the money moving into and out of the business. And with Covid and its aftermath driving added caution, this finance discipline, the procurement discipline, and leaders and their teams in these departments are becoming even more vital. More vital than they have ever been in fact.

Aim for touchless Accounts Payable (AP) processing

This only adds to the ongoing pressure on the finance function of course. But it also presents an opportunity; to step up and start contributing to the business at a more strategic level. Indeed, there has perhaps never been a more opportune moment for finance teams to take the lead; to reinvent and recast themselves in a more pivotal business role.

Where to begin? Data, where else? Building the stability, the insight, and the foresight the business needs around data it can trust. Automating, digitising and optimising key financial data and processes around the goal of true, 100%, real-time financial clarity and transparency.

In the Harvard Business Review Analytic Services (HBRAS) report, Using Transparency to Enhance Reputation and Manage Business Risk, 90% of executives say increased business transparency leads to better-informed decision making across the entire organisation. 26% say transparent finance and procurement processes would lead to an 11% to 20% cost reduction.

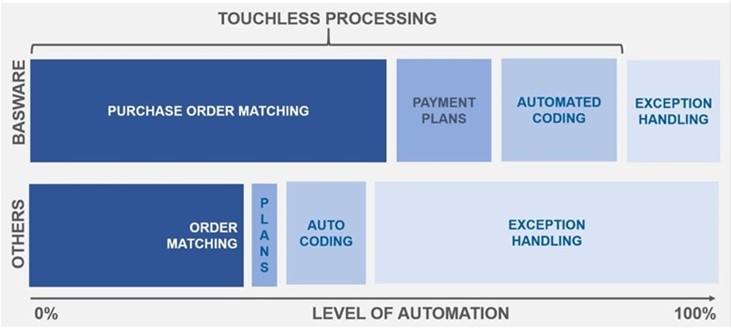

By automating AP processes with Basware, a business could process nearly all their invoices, 95% or even higher, without human intervention. This level of touchless processing contributes to total capture of all your financial data, giving you complete visibility over all your transactions.

Automated AP processes help reduce manual operations while cutting cycle times and overall costs. The more of these automated technologies you adopt, the closer you are to a fully touchless AP. There are a few ways that Basware helps organisations go touchless and automate their AP.

Smart Coding: Automated coding is one way that Basware takes the manual effort out of the hands of the AP team and puts it into the hands of data recognition and machine learning (ML). Smart coding eliminates the need for your AP team to manually code invoices if there’s no purchase order (PO) created to match to that invoice. Using a machine learning algorithm, smart coding technology automatically searches and analyses historical data and invoice coding templates to recommend the proper general ledger (GL) coding of non-PO invoices. By leveraging and learning from company financial data, smart coding continuously improves the accuracy of its recommendations – increasing efficiency, productivity and accuracy of invoice handling.

Payment Plans: Payment plans are a tool that enable AP teams to schedule automatic payments for recurring invoices. Payment plans can be configured in three ways:

- Scheduled payments to automate recurring invoices that require payment at regular intervals

- Budget-based to automate recurring invoices to a specific budget

- Self-billing to automate recurring invoices for amounts that fall within certain ranges

Payment plans allow organisations to take AP automation a step further by extending digital processing to more invoice types. In the journey to touchless invoice processing, organisations apply best-fit matching capabilities, then layer on payment plans and leverage machine learning functionality like smart coding to process as many invoices as possible without human intervention.

Collect Data for Total Procurement Transparency

Most organisations just don’t have the transparency required to combat an ever-changing economy and forecast for the future. In the HBRAS report mentioned earlier, 60% of respondents agreed that a lack of visibility into their suppliers’ practices is a significant risk management issue and as many as 24% admit that, as it currently stands, they’re failing to effectively evaluate supplier business practices.

At a time when customer trust is low, economic uncertainty is on the rise, and the pace of change continues to accelerate, business transparency (operating in a way that makes it easy to see what actions are being performed and to understand how money is being spent across the organisation) can build loyalty with customers, distributors, suppliers and employees; help manage risk and reputation; and establish ethical and sustainable supply chains.

Luckily, there are ways to achieve greater visibility and therefore safeguard your organisation from the pangs of disruption:

-

Eliminate manual procurement processes

-

Integrate innovative tools and technologies

-

Properly analyse your procurement data

The EIU found that 42% of respondents agree that the biggest impact from digitisation will be a greater need for technology investment.

Procurement in particular generates and stores massive amounts of data, and many times that data is spread across many disparate systems making it difficult to organise. But procurement can take control of that data and use it to gain insights, track spend, monitor and manage supplier and vendor relationships, and increase visibility to manage cost savings and risk.

Using an automated, electronic procurement (e-procurement) solution is the best way to standardise processes and centralise all your data. When all procurement data is consolidated, you’ll be in an ideal position to drive value across your organisation. Procurement technologies can drive innovation and cross-functional collaboration by delivering and leveraging a common and complete view of data.

With this complete view of data, your procurement department will gain:

-

Larger, more complete datasets for deeper analyses

-

Forecasted savings and decreased costs

-

Better quality and better-priced goods and services

-

Predictive and advanced analytics

-

Better managed contracts and decreased risks

Short, mid, and long-term business resilience

What practical steps can businesses take in the mid-term and long-terms to bring about such a transition, ensure business continuity, and place Visible Commerce at the core of business management, potentially mitigating future risk if we see such a pandemic again.

In the early days (i.e. perhaps the first eight weeks or so) by:

-

Setting up virtual ‘SWAT teams’ and ‘war rooms’ to handle issues ‘live’

-

Prioritising critical processes and controls

-

Building remote capacity, continuity, and contingency for critical concerns like connectivity, scaling, and tech support

-

Reviewing supplier SLAs and payment terms to ensure critical suppliers are paid fast

Then, in the mid-term (3 to 9 months), through:

-

Process and contingency planning for scenarios like quarantine extensions

-

Eradicating or reducing paper-based processes or manual tasks with automation across your finance and procurement functions

-

Expanding automation technologies to support thorough reporting and analysis

-

Assessing business impacts, the need for mitigation models, and other potential data requirements

And finally, for the longer term, by:

-

Upgrading data and technology capabilities including skills

-

Evaluating tools for areas such as analytics, fraud control, and disaster/pandemic modelling

-

Deepening collaboration with suppliers to drive co-innovation, optimised process integration, and sustainability target planning

As your organisation takes these steps, you’ll realise that by enabling collaboration, particularly between procurement and finance processes, technology can help to close any gaps and drive continuing innovation across your procure-to-pay (P2P) operations.

All of which puts me in mind of a quote from Winston Churchill. “It is a mistake to try to look too far ahead. The chain of destiny can only be grasped one link at a time.”

In any period in history bears that out, 2020 must surely be it.

However, neither can we afford to sit on our hands as according to the EIU report, the businesses that survive, and even thrive, in the new normal will be those able to identify the disruptions affecting their business and act on them sooner rather than later.

Subscribe to the Basware Blog!

Related

-

By Basware RepresentativeThe route to logistics software harmony for finance, AP and procurement

-

By Basware RepresentativeA Reflection on the State of Procurement

-

By Basware RepresentativeHow to create procurement visibility from day 1

-

By Ann StrömbergNordic Leaders Circle focused on procurement development

-

By Katie ColbourneProcure-to-Pay Trends Predictions and Advancements for 2022 and Beyond

-

By Basware RepresentativeBasware to Help Expand e-Invoicing with the Business Payment Coalition

-

By Ann StrömbergProcurement Collaboration, Resilience, Technology, and Sustainability

-

By Basware RepresentativeWhat is e-Procurement?